Important Banking Alert for Budapest Visitors: Four-Day Service Disruption at Major Hungarian Bank

If you’re planning to visit Budapest during the New Year holiday period, there’s an important banking development you need to know about. MBH Bank, one of Hungary’s largest financial institutions serving nearly two million customers, has announced an extended four-day shutdown to upgrade its IT systems. This temporary closure will affect various banking services and could impact your travel plans if you’re not prepared.

Understanding the Shutdown Timeline

The service interruption begins on New Year’s Eve, December 31st, at 10:00 PM local time and extends until Sunday, January 4th at 8:00 PM. During this nearly 96-hour period, MBH Bank customers and visitors who rely on the bank’s services will experience significant limitations. All physical bank branches will remain closed until Monday, January 5th, when they’ll resume normal operations at 8:00 AM.

This extended maintenance window represents a substantial commitment to modernizing the bank’s infrastructure, though it creates a considerable inconvenience for both local residents and international visitors during one of Budapest’s busiest tourist seasons. The timing coincides with Hungary’s traditional New Year holiday period, when many businesses already operate on reduced schedules.

What Services Will Be Affected

The shutdown impacts nearly every aspect of MBH Bank’s operations, creating a comprehensive service blackout that tourists should plan around. Mobile banking and internet banking platforms will be completely unavailable throughout the entire four-day period. This means you won’t be able to check your account balance, transfer money, or manage your finances through the bank’s digital channels if you’re an MBH customer.

The ATM network will experience partial disruptions between January 2nd and January 4th, with cash withdrawals facing intermittent availability. Perhaps more importantly for travelers, ATM cash deposits will be completely suspended throughout the shutdown period. If you’re holding MBH debit cards, you’ll only be able to use them up to the balance shown on your account at 10:00 PM on December 31st, and within any daily limits you’ve previously set.

Online payments using both debit and credit cards may encounter disruptions during this period. The bank’s telephone service, known as Telebank, will operate with restricted capacity rather than full functionality. All instant transfer services, including the popular qvik payment system that uses QR codes, NFC technology, and payment links, will be completely unavailable.

Banking Alternatives in Budapest

Fortunately, Budapest offers numerous banking alternatives that foreign visitors can rely on during this shutdown period. The city is well-equipped with ATM machines from various banks, though knowing which ones to use can save you money and hassle. Major Hungarian banks like OTP, K&H, Erste, Raiffeisen, and Unicredit operate reliable ATM networks throughout the city.

When withdrawing cash in Budapest, it’s crucial to avoid ATMs branded with the “Euronet” logo, which are notorious among travelers for poor exchange rates and high fees. Instead, look for ATMs located inside or directly adjacent to bank branches, preferably those operated by established Hungarian financial institutions. The vast majority of bank-operated ATMs in Budapest are concentrated along Teréz körút, the major boulevard that runs alongside the 4-6 tram line.

OTP Bank maintains the most extensive ATM network in Budapest, making their machines easy to locate throughout the city. Most bank-operated ATMs in Hungary don’t charge withdrawal fees, though your home bank may still apply international transaction charges. Typical fees from Hungarian bank ATMs range from one to three percent for foreign cards.

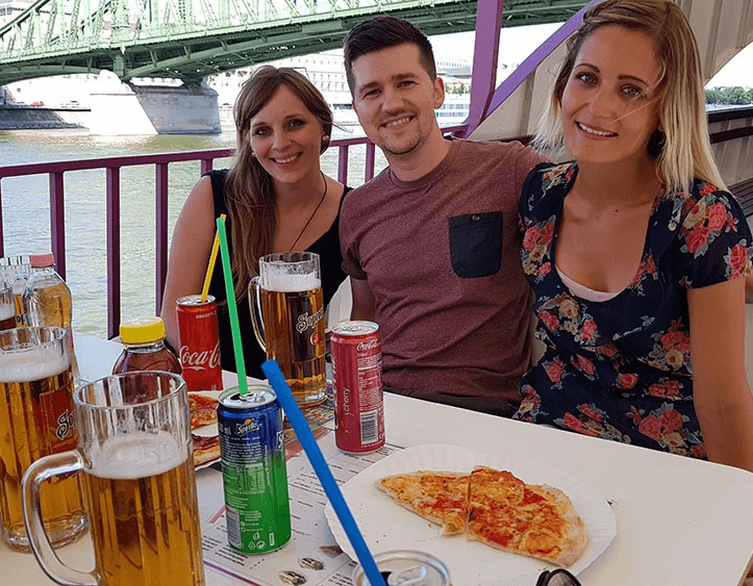

Best deals of Budapest

Card Payments and Cashless Options

Modern Budapest has embraced cashless payments more extensively than many visitors expect. Electronic payment is actually mandated by law at most establishments, with only a few exceptions like outdoor markets and some hairdressers. You can rely on your credit or debit card for the vast majority of transactions in restaurants, shops, hotels, and tourist attractions.

That said, cash remains the most universally accepted payment method in Budapest. Small restaurants, street food vendors, market stalls, and some service providers still prefer or exclusively accept cash. Tipping culture in Hungary strongly favors cash tips, as this ensures the service staff receives the gratuity directly. A sensible approach is to use your card for larger expenses like accommodation and dining at established restaurants, while keeping some Hungarian forints on hand for everyday purchases and tips.

Hungary’s official currency is the Hungarian forint (HUF), not the euro, despite the country’s European Union membership. While some tourist-oriented businesses accept euros, they typically offer unfavorable exchange rates. Always withdraw and pay in forints to get the best value for your money.

Practical Advice for New Year Visitors

Given the MBH Bank shutdown coinciding with the New Year holiday period, international visitors should take several precautions to ensure smooth financial transactions during their stay. Withdraw sufficient cash before December 31st at 10:00 PM if you’re an MBH customer or plan to rely on their ATMs. Consider opening a multi-currency account with services like Wise or Revolut before your trip, as these digital banking alternatives can help you avoid foreign transaction fees entirely.

Load multiple payment methods on your smartphone if you use digital wallets like Apple Pay or Google Pay, as these services work seamlessly throughout Budapest and provide backup options if one card encounters issues. Keep your bank’s international customer service number readily accessible in case you need to report a lost card or resolve transaction problems. MBH Bank’s emergency card blocking service remains operational 24/7 throughout the shutdown at the Hungarian number 06 80 350 350 or internationally at +36 1 373 33 99.

Remember that Hungarian banks typically operate from 9:00 AM to 4:00 PM on weekdays, with most closed on Saturdays and all closed on Sundays and public holidays. This means that even outside the MBH shutdown period, banking services in Budapest are more limited than what many international visitors might expect from their home countries.

Why This Matters for Your Budapest Experience

Budapest during the New Year period attracts thousands of international visitors who come to experience the city’s famous thermal baths, ruin bars, Christmas markets, and spectacular fireworks displays over the Danube River. The city’s tourism infrastructure is generally excellent, but this banking disruption serves as a reminder that even well-developed destinations can experience service interruptions, especially during major holidays and system upgrades.

MBH Bank was formed through a unique triple merger of Budapest Bank, MKB Bank, and Takarékbank, creating one of Hungary’s leading financial institutions with strong market positions in lending, leasing, and agricultural finance. The bank’s decision to conduct this extensive maintenance during the holiday period reflects the complexity of integrating these formerly separate banking systems into a unified platform. While inconvenient for customers and visitors, these infrastructure improvements should ultimately result in more reliable and efficient banking services.

The four-day shutdown won’t prevent you from enjoying everything Budapest has to offer during the New Year celebrations, but advance preparation will help you avoid unnecessary stress. By understanding which banking services will be unavailable, identifying alternative ATM locations, and ensuring you have multiple payment options available, you’ll be well-prepared to navigate any financial transactions during your visit. Budapest’s robust network of alternative banks and widespread acceptance of card payments means that even during this significant banking disruption, visitors have plenty of options to manage their money effectively.